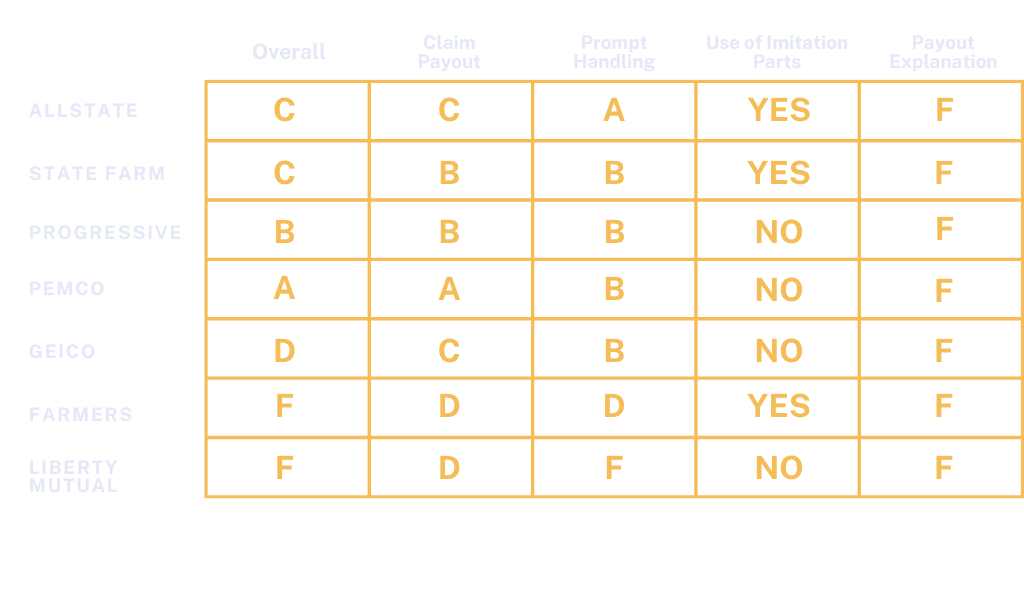

We’ve done the research to give you a one-stop resource for reviewing insurance companies so that you can make an informed decision when buying insurance. These ratings are based solely on Leif’s Auto Collision Center’s 33 years of professional experience and interactions with the top insurers, nationally and locally.